Net income is the portion of gross income that’s left over after all expenses have been met. The term can also mean whatever they receive in their paycheck after taxes have been withheld. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

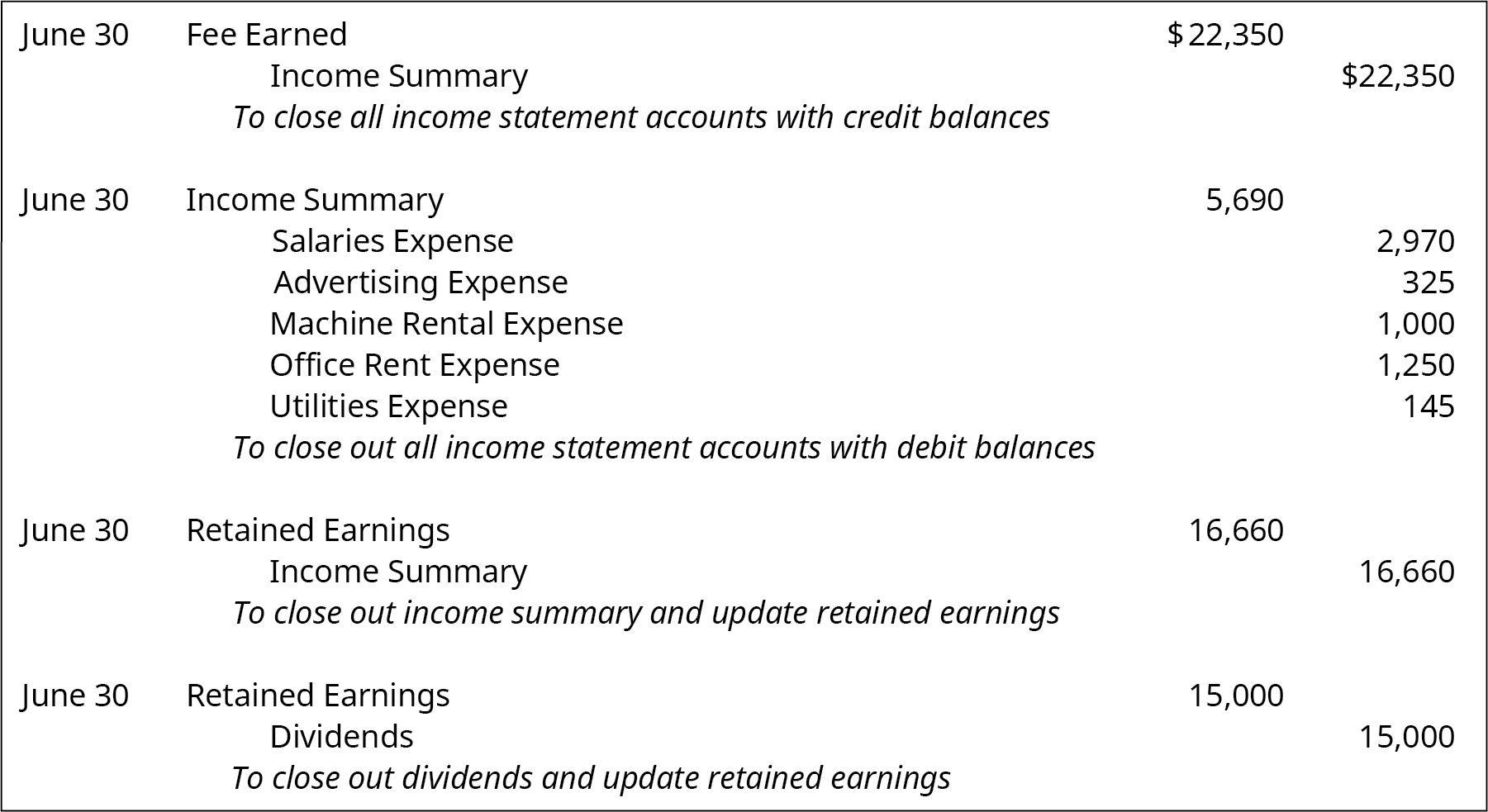

Step 1: Close all income accounts to Income Summary

Doing so automatically populates the retained earnings account for you, and prevents any further transactions from being recorded in the system for the period that has been closed. Closing entries are journal entries made at the end of an accounting period, that transfer temporary account balances into a permanent account. The purpose of closing entries is to prepare the temporary accounts for the next accounting period. In other words, the income and expense accounts are “restarted”. Closing journal entries are made at the end of an accounting period to prepare the accounting records for the next period.

How to close an income summary account?

A closing entry is a journal entry made at the end of an accounting period. It involves shifting data from temporary accounts on the income statement to permanent accounts on the balance sheet. These accounts must be closed at the end of the accounting year. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining. The main change from an adjusted trial balance is revenues, expenses, and dividends are all zero and their balances have been rolled into retained earnings.

What Is Net Income?

In summary, the accountant resets the temporary accounts to zero by transferring the balances to permanent accounts. A temporary account is an income statement account, dividend account or drawings account. It is temporary because it lasts only for the accounting period. At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance. For each temporary account there will be a closing journal entry.

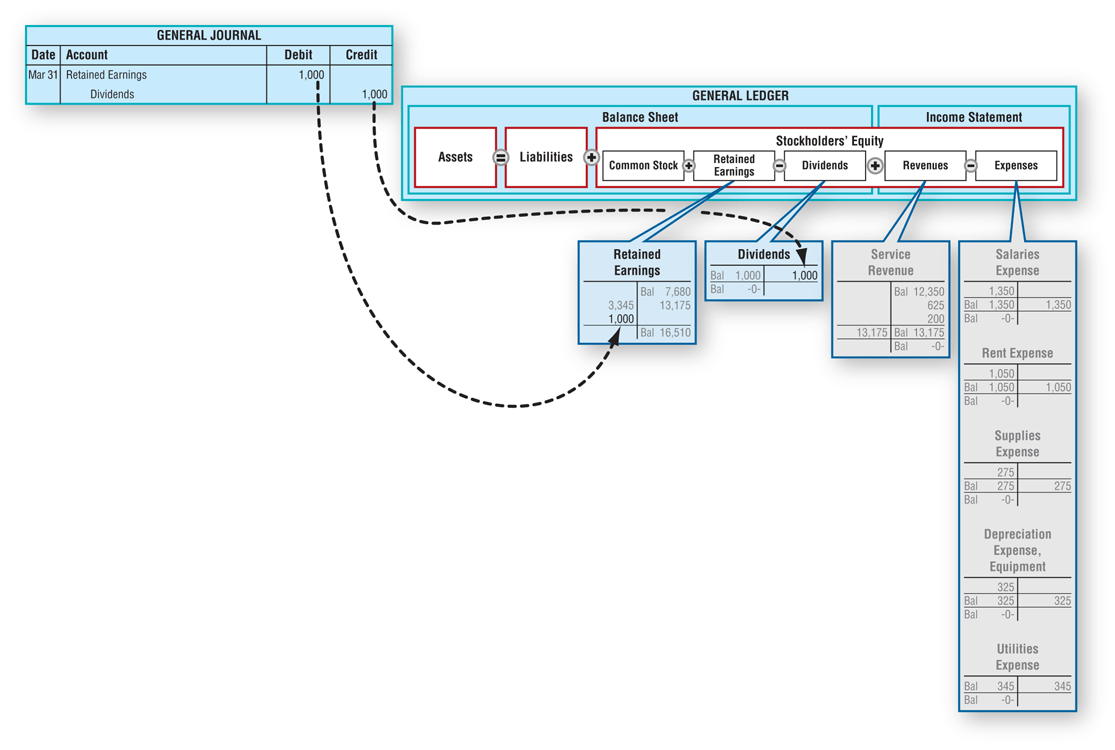

Closing entries transfer the balances from the temporary accounts to a permanent or real account at the end of the accounting year. In this case, if you paid out a dividend, the balance would be moved to retained earnings from the dividends account. Once this has been completed, a post-closing trial balance will be reviewed to ensure accuracy. A business will use closing entries in order to reset the balance of temporary accounts to zero. Let’s investigate an example of how closing journal entries impact a trial balance.

Ready to Experience the Future of Finance?

As we mentioned, the income summary is a temporary account in itself. You will start by clearing out the income accounts from the income statement (revenue) and crediting the income summary. First, you are going to start by identifying the temporary accounts that need to be closed. As we mentioned, these include revenue, expense, and dividend accounts. Only incomestatement accounts help us summarize income, so only incomestatement accounts should go into income summary.

- The Printing Plus adjusted trial balance for January 31, 2019, is presented in Figure 5.4.

- The next day, January 1, 2019, you get ready for work, butbefore you go to the office, you decide to review your financialsfor 2019.

- They’re housed on the balance sheet, a section of financial statements that gives investors an indication of a company’s value including its assets and liabilities.

Once adjusting entries have been made, closing entries are used to reset temporary accounts. The first entry closes revenue accounts to the Income Summary account. The second entry closes xerocon san diego 2019 expense accounts to the Income Summary account. The third entry closes the Income Summary account to Retained Earnings. The fourth entry closes the Dividends account to Retained Earnings.

Steps 1 through 4 were covered in Analyzing and Recording Transactions and Steps 5 through 7 were covered in The Adjustment Process. Closing entries are the journal entries used at the end of an accounting period. Do you want to learn more about debit, credit entries, and how to record your journal entries properly?

To determine the income (profit orloss) from the month of January, the store needs to close theincome statement information from January 2019. Once all the adjusting entries are made the temporary accounts reflect the correct entries for revenue, expenses, and dividends for the accounting year. We can also see that the debit equals credit; hence, it adheres to the accounting principle of double-entry accounting. Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period.

Having a zero balance in theseaccounts is important so a company can compare performance acrossperiods, particularly with income. Closing journal entries are used at the end of the accounting cycle to close the temporary accounts for the accounting period, and transfer the balances to the retained earnings account. Notice that revenues, expenses, dividends, and income summary all have zero balances.